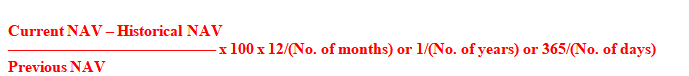

after six years, the NAV has increased to ₹50. Let us take an example to help understand this concept better.Īssume that you had invested ₹1 lakh in a mutual fund scheme in 2015. You can calculate the CAGR on an excel sheet. However, to calculate lumpsum investment with an investment period of over 12 months, youĬan use Compounded Annual Growth Rate (CAGR).Īlthough your investment will give different returns at different phases, CAGR gives the average annual growth rate. You can use absolute returns and simple annualised returns when the investment period is less than one year. If you take the previous example, the annualised return will be The value of the absolute return is used to calculate the simple annualised return. Would have generated if you stayed invested for a year, the simple annualised return can help you do that. But, if you want to check your annual returns, i.e., how much you So, if your initial NAV was 20 and the present NAV is 35, and you had stayed invested for seven months, the absolute returns would be 75%.įrom the previous example, Absolute Returns can be helpful to calculate returns for investments that stayed invested for less than 12 months. NAV is nothing but the price of one unit of a mutual fund.Ībsolute return = (Present NAV – initial NAV) / initial NAV × 100 All you need is the initial Net Asset Value (NAV) and the present-day NAV. It is easy to calculate absolute returns. In this article, you will look at the different ways to calculate mutual fund returns. When calculating mutual funds returns, it is crucial to note the initial investment and redemption dates. Whether you are investing in mutual funds through a lump sum, SIP or a mix of the two routes, you all would want to invest in mutual funds that can give expected returns.īut have you wondered how mutual fund returns are calculated? And does the calculation differ between lumpsum investment and regular investments? You can invest by either making a lumpsum investment or setting up a Systematic Investment Plan (SIP) for regular investments.

There are two ways to invest in a mutual fund. * Distribution rates are an investment objective and not a forecast.Ī copy of the PDS and TMDs can be downloaded from our website.Ĭopyright © 2022 Australian Secure Capital Fund Ltd, All rights reserved.How to Calculate your Mutual Funds Returns - SIP and Lumpsum Investments Prospective investors should consider those matters, read the PDS & target market determinations (TMDs) for the Funds in their entirety and obtain independent expert advice before making an investment decision. It does not purport to be complete, nor does it take into account your investment objectives, financial situation or needs. This website contains general information only and should not be considered as giving financial product advice or any recommendation by ASCF. Past performance is not indicative of future performance. Any information about returns should be considered only as part of a balanced review of the features, benefits and risks associated with an investment in the Funds. The performance of the Funds, the repayment of capital or of any particular rate of return is not guaranteed and unless expressly stated, performance information contained on this website is not intended to constitute forecasting of future performance.

Withdrawal rights are subject to liquidity and may be delayed or suspended. An investment in a Fund is not a bank deposit. There is a risk that you may lose some or all of your capital and/or a reduction or cessation of distributions. ASCF is the responsible entity for the ASCF Premium Capital Fund ARSN 637 973 409, the ASCF Select Income Fund ARSN 616 367 410 and the ASCF High Yield Fund ARSN 616 367 330 (Funds).Īs with all investments, each Fund is subject to risks which are set out in the Product Disclosure Statement (PDS). This website and the information contained in it has been issued by Australian Secure Capital Fund Ltd ACN 613 497 635 AFSL and ACL number 491201 (ASCF).

0 kommentar(er)

0 kommentar(er)